For Investors

Much like creating an architectural plan before building a home, we believe co-creating a strategy is an important piece of your impact investing journey.

The co-creation of your impact investing strategy is most effective when done in collaboration with your various advisors, including tax, accounting, legal, financial, estate, and insurance advisors. This ensures appropriate recommendations are made in a holistic way considering estate structure, tax efficiencies, insurance coverage, asset allocation, and capital market expectations.

Every client and every portfolio is different. We work with you to determine a fair and appropriate flat-fee based on the complexity of the analysis and timeline to complete. Typically a full strategy takes place over 4-8 months with four in-person, three-hour meetings, and calls in between to work towards a deliverable strategy. We’re committed to tailoring our engagement to your preferences. That might include shorter or longer meeting times, more or less frequent meetings, etc. We’ll do our best to meet you where you are!

1) values discovery

What’s your why, what drives you, what gets you out of bed in the morning, if you could only move the needle on one thing, what would it be and why?

⬤ ⬤ ⬤

2) documenting your Preferences

Document your preferences for your assets in the public markets, private markets, and philanthropy.

⬤ ⬤ ⬤

3) Frameworks for Impact

Landscape analyses for context on why certain social and environmental issues exist, who the players are, and how your capital can support solutions.

⬤ ⬤ ⬤

4) Current portfolio assessment

What’s in your portfolio today and how aligned is it with your articulated values and preferences?

⬤ ⬤ ⬤

5) Recommendations for Alignment

Tying everything together with recommendations on how to better align your portfolio with your values.

Now that you have a strategy, it’s time to implement and #StayAligned.

Whether you self-manage, have staff, or a team of advisors, we’re here to be your “impact quarterback” to implement your impact strategy across all aspects of your estate or portfolio and help you #StayAligned.

We meet you where you are and integrate with the infrastructure, reporting, advisory, and custody relationships you already have in place—or, we can help find or build the right infrastructure, advisory/custody relationships you need.

Every client and every implementation is different. We work with you to determine a fair and appropriate fee based on the complexity of your implementation.

1) Implement Strategy

Implement initial recommendations outlined in your impact investing strategy.

⬤ ⬤ ⬤

2) Sourcing, diligence, ongoing recommendations

In alignment with your values and strategy, we curate a pipeline of opportunities, conduct diligence, and make recommendations across public, private, and philanthropic markets.

⬤ ⬤ ⬤

3) Monitoring and reporting

…on the financial and impact performance of your investments and grants on an ongoing basis.

⬤ ⬤ ⬤

4) Learn, evaluate, optimize

Consistently reevaluate and reiterate your impact investing strategy with changes and lessons learned over time.

⬤ ⬤ ⬤

5) Back office

Assist with subscription documents, capital calls, generating liquidity, help prepare/participate in Board and/or Investment Committee meetings, back-office support, etc.

⬤ ⬤ ⬤

6) Specialty diligence and services

Direct investing, first time fund managers, Program Related Investments, Recoverable Grants, Board education, Next Gen Education, specialty landscape analyses, organizing your historical investment data, and more!

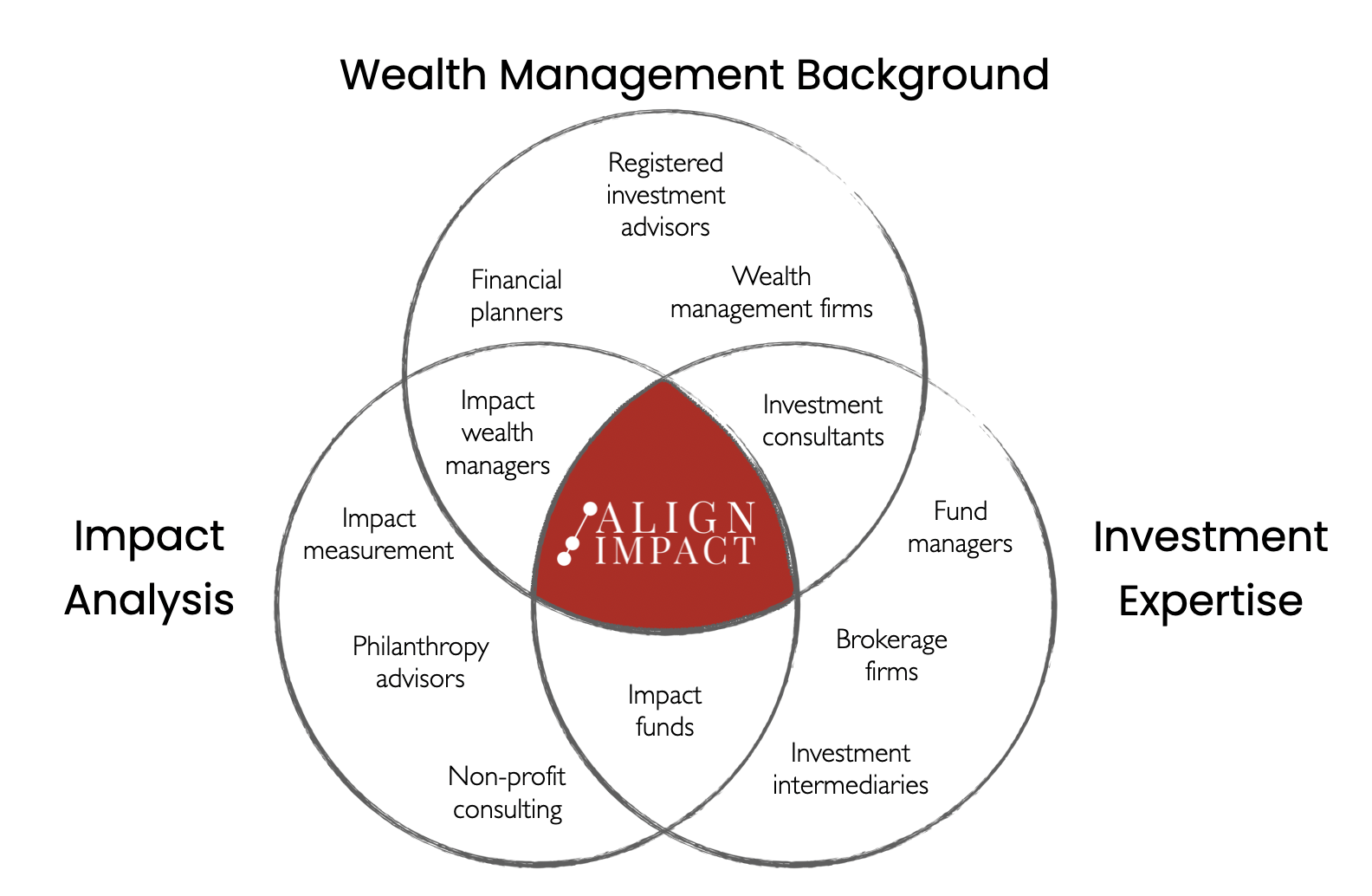

Our role as your impact investing specialist